Stay Ahead of the Game: Important 2022 Tax Updates for Baby Boomers

Paying taxes is something you can’t escape; but being aware of new tax rules and revised federal deadlines can make preparing and paying your taxes a little less painful each year. Here are five major tax revisions – plus noteworthy cutoff dates – every baby boomer needs to know ASAP to avoid late fees, cash in on potential savings and prevent future tax burden headaches.

1. The April Tax Deadline Is Rapidly Approaching

Over the last few years, the tax filing cutoff date has been extended. Please be aware that this year you “only” have until April 18, 2022 to file your taxes and avoid penalties. Helpful hint – don’t forget to let your tax preparer know if you’ve made any 2021 individual retirement account (IRA) contributions, Roth conversions or qualified charitable distributions (QCDs).

2. The Charitable Donation Deduction for Standard Filers Has Ended

Giving to a nonprofit is a great way to give back to your community. In 2020 and 2021, those donating cash to a charity were able to make a deduction of up to $600 ($300 for individual filers) on their taxes. Unfortunately, due to the elimination of this exemption, you won’t receive a tax break for your kind deeds in 2022 unless you itemize.

3. Standard Deduction Increases

If you are not itemizing, the 2022 standard deduction (the amount that can be withheld from your income before tax is applied) has been raised. The sum for single filers has been increased by $400 to $12,950; the sum for married individuals filing jointly increased by $800 to $25,900.

For those over 65, an additional standard deduction of $1,400 is allowed for a married individual (filing jointly or separately) or a qualifying widow(er) who is 65 or older or blind. This is up to $2,800 total per spouse. For an unmarried individual (filing single or head of household), an additional $1,750 is allowed for those 65 or older or blind, up to $3,500 total.

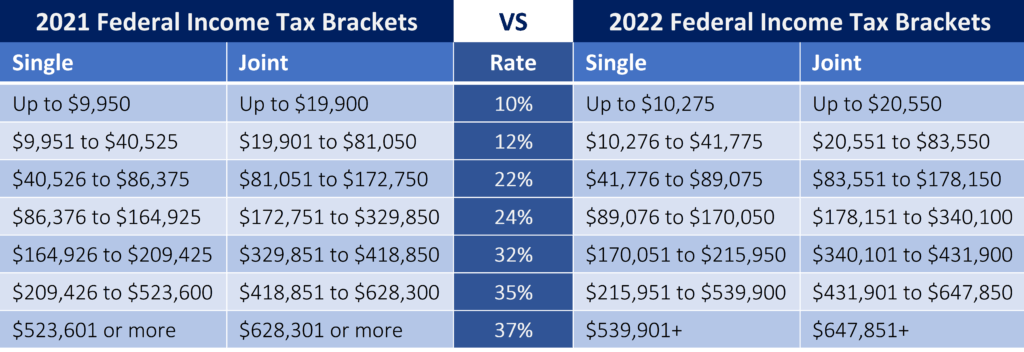

4. New 2022 Income Tax Brackets

The IRS announced its inflation adjustments for the 2022 tax year. The taxable income needed to hit tax brackets has increased by about 3%. Below are the federal income tax bracket ranges for both 2021 and 2022:

5. 2022 Capital Gains Brackets

A proposed long-term capital gains rate for 2022 of up to 25% has not come to fruition. It’s important to remember that short-term capital gains are taxed as ordinary income (see chart above). For taxpayers with modified adjusted gross income over $200,000 for those filing singly or $250,000 for those married filing jointly, an additional 3.8% Net Investment Income Tax (NIIT) may also apply.

For more 2022 tax limits and numbers, see our 2022 Tax Guide. And you can download our tax calendar to help you keep an eye on important 2022 tax deadlines.

While we hope you find value in these tips and reminders, we encourage you to consult your wealth advisor and tax professional about the right tax strategies for you. let us know how we can help you plan.

Article By: PATRICK KUSTER, CFP®, AIF® at Buckingham / Strategic Partners

For educational and informational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. The above is based on information available at the time of drafting this article and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements, or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability, or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products, or services available on or through them. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article.

Copyright: 2022 Stonebridge Wealth Management